can you get a mortgage with back taxes

Paying mortgage interest does not provide any additional tax savings unless the amount of interest paid during the year is higher than the standard deduction. All taxes must be brought current at the time of the loan and if you have been late on property taxes mortgage payments or any other property charges in the past 24 months ie.

Buying Your First Home Turbotax Tax Tips Videos

You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history.

. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a. If you owe other kinds of taxes like property tax or state tax you might still be able to get approved for a mortgage. The appearance of any court judgements or statefederal tax liens on an applicants credit history will require the lender to halt processing.

Over 937000 Americans have. Getting a mortgage can take more time and. You CAN qualify for a mortgage without paying off the entirety of your tax debt.

Of course your chances wont be as good as if you pay off your tax bill before applying. HOA dues the lender will require a Life Expectancy Set Aside per HUD guidelines to pay these expenses. If you owe back taxes previous years- not 2019 and they are subject to a lien then you must have a payment arrangement in place and have made 3 payments before.

As of September 2012 the standard. If your DTI is 44 without the IRS monthly payment determine how can pay and still keep your. In short yes you can.

A smaller monthly payment will impact your debt-to-income DTI ratio the least. The first obstacle youll face when trying to get a mortgage with unfiled taxes is the mortgage lenders requirement for a tax transcript. In general your likelihood of being approved for a home loan varies based on your individual circumstances but any type of debt added to your borrower profile can make you a riskier applicant in the eyes of a lender.

You will be able to obtain a home loan if you owe taxes even if you do not have the income. Generally lenders request W-2 forms going back at. Can you get a reverse mortgage if you owe back property taxes.

Owing back taxes to the IRS can complicate your life in several ways. Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien. Tax liens and judgements.

In a reverse mortgage you get a loan in which the lender pays you. A mortgage lender will want to see your. Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it.

You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. Can I Get A Mortgage To Pay Back Taxes. However there are different requirements depending on the type of mortgage you are applying for FHA.

With some careful planning you can still get the loan you need despite owing back taxes to the IRS. As the gig economy booms and side hustles take off delinquent tax debt is. While homeownership is a goal for many people owing taxes to the IRS can make.

So if you earn 5000 a month and make a 300 a month tax payment at a 4 percent rate you could borrow almost 63000 less with the tax lien than without it. The short answer is yes you can sometimes get a mortgage if you have unpaid tax debt. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of.

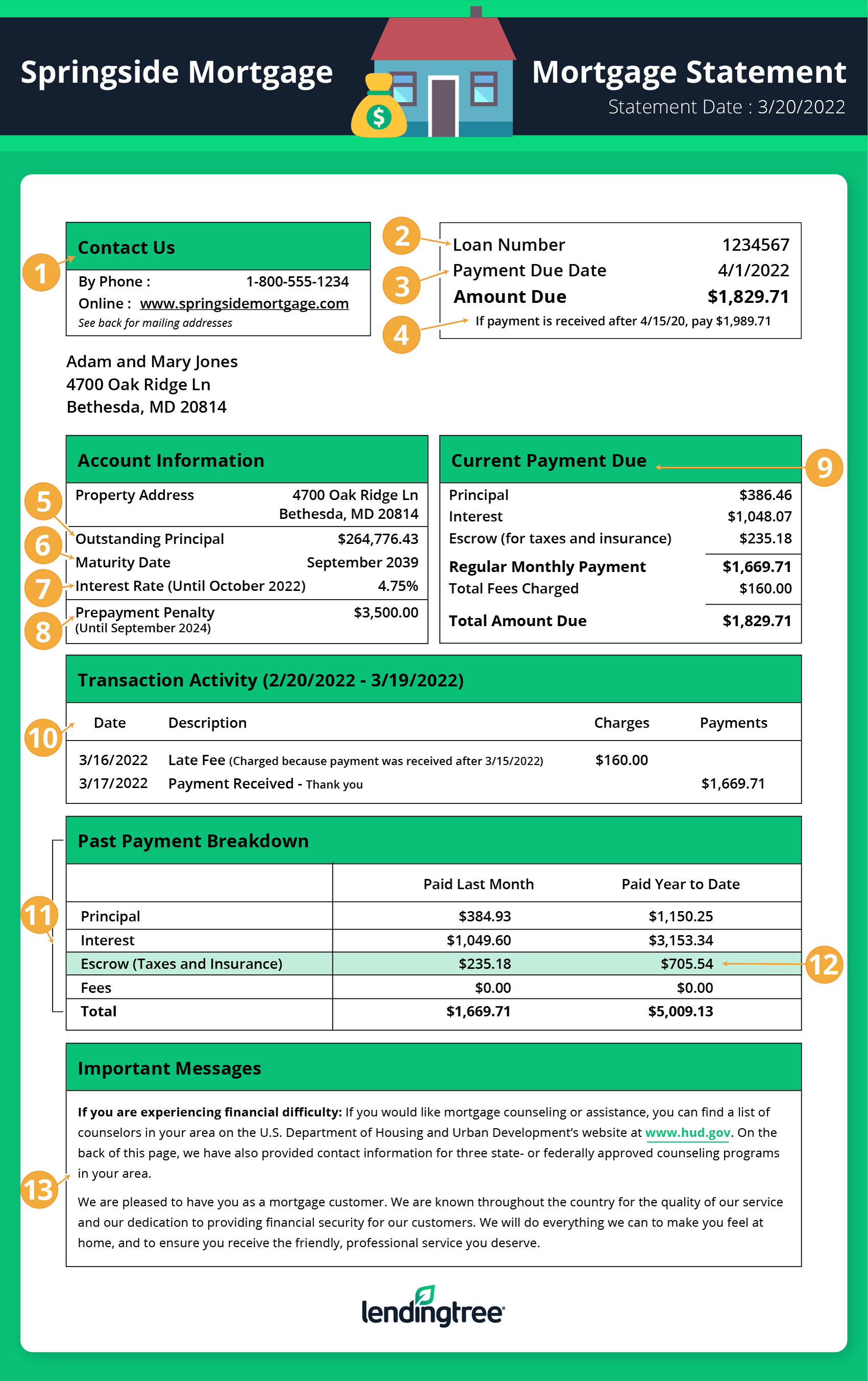

How To Read A Monthly Mortgage Statement Lendingtree

Is It Possible To Buy A House If I Owe Back Taxes

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

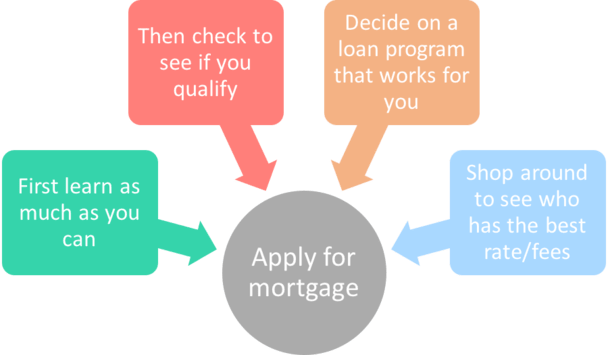

How To Get A Mortgage From Start To Finish

.jpg)

Know How Much Home You Can Afford Greenway Mortgage Blog

Can You Get An Fha Loan If You Are Paying Irs Back Taxes Sapling

Can You Get A Mortgage If You Owe Back Taxes

Can I Buy A House If I Owe Back Taxes

Can I Buy A House Owing Back Taxes Community Tax

Why Did My Mortgage Go Up Rocket Mortgage

Lenders Now Must Report More Information About Your Mortgage To The Irs The Washington Post

How To Buy Real Estate By Paying The Back Taxes Millionacres

A House Was Sold For Unpaid Taxes How Can I Become The Owner The Washington Post

Ask The Underwriter My Borrower Owes A Federal Tax Debt To The Irs Is This Mortgage Deal Dead Housingwire

Can You Buy A House If You Owe Taxes Credit Com

:max_bytes(150000):strip_icc()/yourfirstmortgagepayment-90c333d703294d40ae023eccb89ae910.png)

When Is Your First Mortgage Payment Due After Closing

Complete Checklist Of Documents Needed For A Mortgage Mortgages And Advice U S News

Can Unpaid Taxes Stop You From Getting A Home

How To Get A Mortgage When You Re Self Employed Rocket Mortgage